Key Takeaways

We expect Palantir to be one of the dominant enterprise solutions for large cap industrials manufacturers and utilities provider, with unrivaled software solutions and data analytics, yielding accelerated revenue growth into the investment horizon.

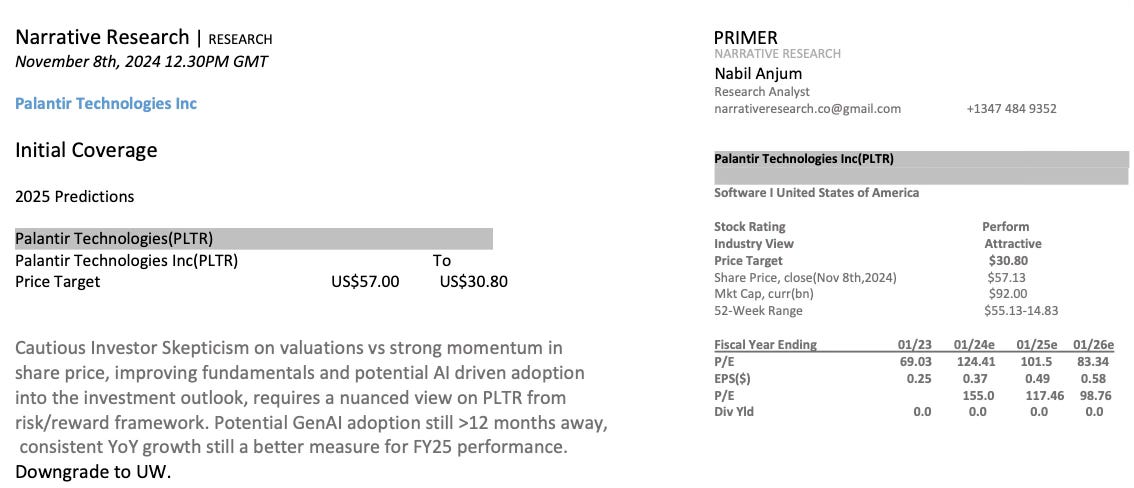

Despite expecting improvement in overall business performance in FY25, the stock trades at a large premium to mid-cap/large-cap Software peers as well as large cap Defense & IT Providers on a P/E basis.

We remain skeptical on Palantir's AIP as a value addition to the Foundry Enterprise solution and believe Ontology already executes majority of the function embedded into AIP.

Palantir's contract growth of >$5MM has been suboptimal while contracts yielding >$10MM are limited to companies generating >$10BN of annual revenue.

Why We Are Skeptical on PLTR

While PLTR shares have outperformed large-cap software peers as well as the Defense & IT sector in 2024, we attribute much of this outperformance to momentum pricing (Exhibit 15), driven by S&P 500 inclusion, heightened retail engagement, and high expectations around profitability.

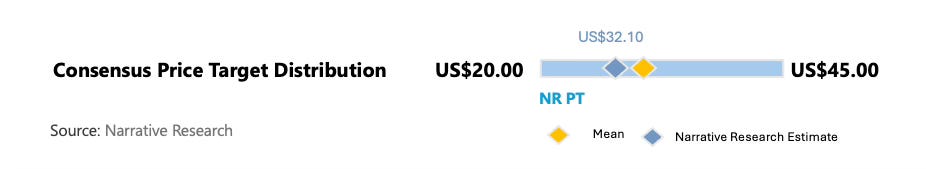

Despite maintaining a view that PLTR will grow its business, led by favorable market positioning and a transformative AI adoption theme, and forecasting margins above 30% into our investment outlook, we struggle to support a valuation above our $30.80 price target. Our view is supported by PLTR's current share price of $55, trading at a P/E multiple of 124x—a sizeable premium compared to 59x for the Defense & IT sector and 109x for mid-cap application software peers. The potential upside seems limited on a risk-adjusted basis (Exhibit 13) for a stock already up approximately 229% YTD. In addition to pricing concerns, we also note potential hurdles for PLTR to realize sustainable compounding growth and capture market share in the commercial sector.

Our concern mainly arises from Palantir’s ability to fully deploy its enterprise solutions—where its products have a competitive edge—due to competition from more specialized enterprise software providers and a limiting target market.

Within the sub-$1MM contract range, Palantir secured 183 contracts in 1H FY2024 (+41% YoY) across diverse sectors. However, growth in contracts over $5MM has been relatively muted at 15.4% YoY, reflecting a challenging environment for mid-cap enterprise deals. PLTR’s Gotham and Foundry platforms excel in complex, large-scale implementations, yet face barriers in scaling down to smaller, cost-sensitive markets.

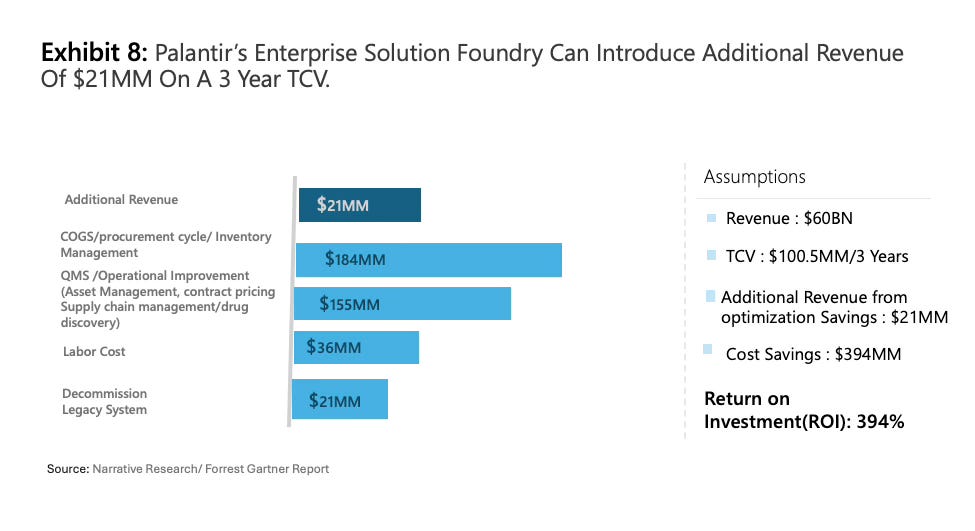

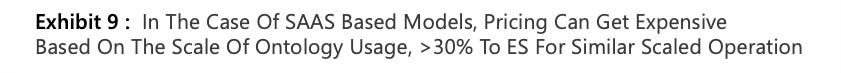

In the commercial arena, there are relatively few companies operating at a scale that supports $60 million+ TCV contracts (Exhibit 8). While Palantir could theoretically increase prices to offset the limited volume, the ~40% CAGR in TCV over four years suggests that Palantir's pricing is already considered high compared to mid-market competitors like Informatica, IBM Watson, and other data providers. The lower end of the market (> $1MM TCV) contracts are lower yielding for Palantir and are deployed on a SaaS usage-based model with variability in usage-based compensation. The bootcamp model is a positive addition to companies and has been an entry strategy for PLTR, allowing subscribing customers at low CAC. This is partly driven by Palantir being more flexible in this environment regarding pricing, as competition is intense with many alternatives to Foundry. However, the main hurdle remains convincing customers to deploy premium-priced software built for complexity resolution in a very non-complex operation. The middle-market space (> $5MM TCV) remains an area for improvement, as YoY growth has been limited with 8 additional contracts in the first half of FY2024 (+15% YoY).

Palantir’s flagship contracts with notable companies (Ferrari, British Petroleum (BP), Exxon, Boeing, Sonoma) (Exhibit 7) were partially product-cycle-driven partnerships or notable event-driven deployments. However, these contracts yield the largest ROI for Palantir, with >55% margin (NR estimates). Gartner’s report on Foundry suggests that while Palantir is deployed on an Enterprise Solution basis, it is occasionally limited to procurement cycles, which limits the level of utilization supported by Foundry’s complexity reduction. We are not fully convinced that all notable participants noted above have had contracts renewed (BP announced in Q3). The report further provided insight into the level of operational magnitude required ($50Bn in global revenue) for PLTR to earn these high-ticket contracts (Exhibit 8). While we believe the overall enterprise solution market is >$90Bn, we see Foundry’s core market participants as more limited.

In the government sector, we potentially see headwinds driven by fiscal constraints and limited growth from DoD (O&M) and (R&D) spending for CY2025 and CY2026. The potential impact of a change in the presidential term seems too early to suggest, but our overarching belief is in a level of de-escalation in global conflicts or a more muted response from the United States in defense aid. From a global perspective, our view on PLTR’s customer base is that it may shrink, driven by a slowdown in the utility and manufacturing sectors in Europe, particularly the automobile sector. We have accounted for two of the following three factors in our outlook (negating the election impact).

NARRATIVE RESEARCH | RESEARCH

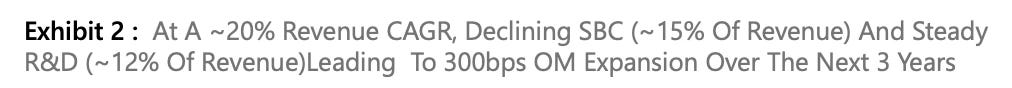

What’s particularly attractive for investors is Palantir’s operating margin of over 35%, approximately 10% better than median peers, placing PLTR in a unique bracket of software providers serving both commercial and government sectors. The operating margin has been a key highlight for investors who potentially view PLTR as a high-growth, high-margin play. Management’s handling of SBC has been one of the driving factors toward PLTR reaching profitability. Our research suggests some SBC attributions are primarily related to management operations.

Notably, PLTR’s relatively modest investment in R&D—$350 million (around 13% of revenue)—is approximately 700 basis points lower than the industry average of 20%, trailing behind competitors such as IBM, Snowflake, DataDog, and Informatica. While there have been several recent additions to the Foundry stack (AIP), we feel there is room for improvement in the product line, particularly with users reporting concerns regarding the user interface and operability.

Our view is that companies should be flexible as monetary conditions loosen and invest competitively to maintain distinction from general-purpose AI models, which could potentially converge with proprietary enterprise models in terms of capability. The generative AI landscape remains highly competitive, demanding substantial ongoing investment to maintain market share.

This further emphasizes PLTR’s customer acquisition, reflecting an organic approach based on a concentrated effort to uphold Foundry’s presence in its respective verticals, primarily in fixed asset businesses and through deploying bootcamp models (trial solutions). While we do not discount management’s view on growing organically, we feel that as customers upgrade legacy software in the current AI cycle, PLTR would benefit from a high-growth strategy to lock in customers for the foreseeable future and provide room to compensate for margin. The timeline aligns well with PLTR’s average ~3-year decommissioning of legacy enterprise solutions, fitting into our expected market peak around CY2027.

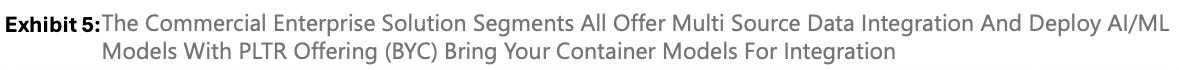

The addition of AIP as a GenAI software is a welcome expansion to the Enterprise Solution Stack, but one year into the product launch, it’s hard to identify key differentiators between AIP and open-sourced LLMs. While we were impressed by J.D. Power’s utilization of AIP to build a customer interface for product selection, we were left wondering if the software could have been built entirely using open-sourced LLMs. Notably, many of PLTR’s large >$10MM contract customer base consists of industrial manufacturers who might have lower utility for such features. Prior to AIP, Ontology was branded as the AI/ML solution for driving insights and business solutions and remains a unique product feature for Foundry.

Narrative Research | RESEARCH

Narrative Research | RESEARCH

Palantir’s Foundry platform is strategically positioned to enable large-scale enterprises to modernize their operations, effectively replacing legacy systems within a three-year implementation period. Foundry’s extensive service suite—offering over 100 micro-services—delivers significant cost savings across procurement, operational expenses, and workforce optimization by streamlining division management. The multi data structure support framework and rapid integration of existing business is vital for large scale operators requiring constant operational deployment and reliable security framework.

Foundry’s Enterprise Solution is particularly notable in asset-intensive sectors such as Utilities, Automotive, and Logistics, where it drives enhanced global asset management, real-time monitoring, and operational efficiency. NR estimates suggest that PLTR’s ROI for companies upon deployment stands at a median return of approximately 394% on a 3-Year TCV. The level of impact varies based on the rate of utilization, particularly when expensed as a percentage of Inventory Management. Further utilization stems from sensory monitoring on business machinery (IoT), which requires real-time insights. Functionally, the software processes all the data to optimize for cost allocation and future pricing, serving as a relatively flexible tool for financial servicing.

This flexibility is particularly evident in pricing applications across various verticals, including automobile repair estimation (using historical data) and forecasting estimated energy pricing. In Palantir’s Q3 Call (FY2024), CEO Alex Karp noted a recent partnership with an insurance provider to overhaul the underwriting process. There is potential for sizable impact across many verticals with proper utilization and strategic market entry.

Narrative Research

Concerns regarding Palantir's steep Valuation

Valuation Methodology

For Palantir, our methodology uses an analysis that culminates with the development of forward projections of earnings, balance sheet, and cash flow statements. Using this we calculate measure of current and projected comparable EV/FCF and price to sales ratio. These calculations form the basis of our judgement.

Despite the positive spin on Palantir's future outlook we remain skeptical that a company trading at 104x earnings represents fair value of the business and are downgrading to market perform. We expect the current momentum driven by the inclusion to S&P in late September to fade and Palantir's stock price to adjust over the first half of FY2025. The underlying fundamentals remain strong for the business but the AI premium sees the company trade, at an EV/FCF of 99x ,Average (30x) (Defense & IT Industry) and 45x Average for Application Software Peers.

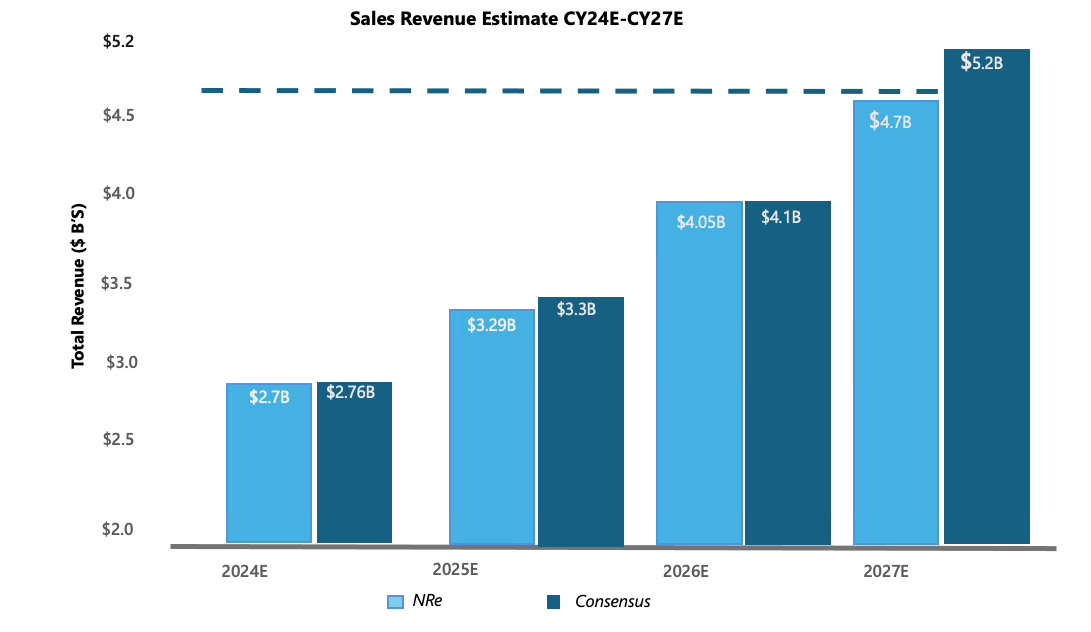

Our model as initial coverage sits 10-11% below consensus for FY25 respectively.

Forecasting ~23% growth in 2025 led by commercial wins primarily in the Utilities , Supply chain/Retail sectors and further growth in government secured contracts. Our below consensus target is also driven by expectation in slowdown in defense spending over 2025 and 2056 primarily related to slowdown in operation maintenance and R&D spending across all defense verticals driven by fiscal constraints.

We expect operating margins to peak in 2027 at 37% as the artificial intelligence market cycle is in maturity for deployment on new enterprise solution and pricing power peaks as existing competitors alternatives to Foundry's solution are available. Palantir CAGR for contract value is

~43% since 2020 and we expect slowdown in those numbers to around ~30% CAGR by 2028

Upside Narrative: Our upside narrative builds on PLTR ramping up for an acquisition within CY2027, targeting the lower/middle market of enterprise solution providers to further establish its footprint. Furthermore, our upside narrative is driven by our broader thesis that anticipates some consolidation in the enterprise solution sector, driven by firms' unprofitable stance. Fifty percent of our middle-market comps are projecting negative earnings in FY26, while an additional seven are yielding over $250MM in earnings. The divergence in profitability, despite an average net revenue retention rate of 117%, leads us to believe there will be potential opportunities in the space. Palantir's strong integration as a software solution adds potential synergies to viable deals. This would potentially address PLTR’s inconsistent commercial growth problem, primarily serving TCV >$5MM, without having to reorient Foundry. Management has yet to signal any potential M&A in the pipeline; however, we believe this is a strategic view by management to pursue deals at more attractive valuations. Forward earnings for CY26 suggest software application peers are trading at a median 56x P/E compared to the current median of 90x.

(2)PLTR is able to maintain and grow its contract value at the current rate of CAGR +40% into the next decade, driven by the increasing moat of its software technology and the limited number of players offering a similar level of enterprise solution. PLTR's ability to operate in very specialized environments with business operations deemed "mission critical" causes product stickiness, as companies prioritize smoothing operations over innovation.

(3)Foundry’s marketplace and Fed Start program develop as PLTR has a significant moat in terms of security clearances and operational intellect to offer firms planning to sell software to the government. Few companies are as well-positioned for a market expected to grow at ~9% CAGR into CY2029.

Downside Narrative: (1)While management has done exceptionally well to steer the company through challenges since its IPO, the outlook is unclear whether they can sustain consistent growth. PLTR’s commercial base has historically consisted of utility providers, industrial manufacturers, healthcare, etc.(2)We see potential headwinds for the utility sector, primarily renewables, based on leveling off from tax harvesting related to the IRA Act as well as the Infrastructure Bill, potentially tapering off PLTR’s demand base. Furthermore, similar headwinds could target defense spending, as we expect negative growth in defense spending in FY2025 and FY2026. Noting Palantir’s concentrated customer base and modest growth, we feel potential headwinds could resurface questions regarding management’s potential and long-term success.

(2) Noting PLTR’s historical volatility (Overweight on our factor index), we feel potential negative earnings could cause large swings in price. Underperforming street estimates, on average, yielded PLTR -18% in returns. Adding to this, the fact that the Underweight narrative is the median view of the market, we fail to see potential catalysts for pricing. Peer groups of mid/large-cap application software (SNOW, DataDog, MDB) had historical multiples compared to PLTR’s current valuation of over 100x P/E, before a negative spiral that led them to now trade below par value/reference price. PLTR’s market beta on a peer-adjusted basis (Mid Cap Application Software) remains neutral; however, non-adjusted beta (1.90) is relatively high. In 2023, at its trough, the market had positively priced PLTR as Overweight based on its attractive valuation (P/B Value) and an exceptional AI Enterprise Solution. Currently, the market holds only one of those views. Our downside narrative is to not own the stock and wait for it to trade at a price where the valuation does justice.

Narrative Research | RESEARCH

MARKET PERFORM NARRATIVE

Palantir’s technology stack is an exceptional software solution uniquely positioned as a bridge between enterprise solutions for commercial usage and a security intelligence platform. Despite these strengths, our market perform narrative is based on PLTR’s potential hurdles driven by growth caps from restricted usage of Gotham beyond U.S. intelligence, and coupling our fiscal driven slowdown in U.S. defense spending on R&D and operational maintenance in 2025 and 2026.

In the commercial business, PLTR’s target market for contracts exceeding $10 million is potentially limited to companies generating over $15-20 billion in revenue within large industrial verticals, where opportunities are comparatively constrained. Potential upheavals in these given vector’s could potentially shake up PLTR’s contract base noting in Q2 FY2023 Top 3 customers generated $415MM in Q2.PLTR’s concentration risk by Top 20 customers yield at ~46%, or $1.1Bn of Total Revenue for FY24. While we don’t fully view this as concentration risk, we view certain verticals being market sensitive. Beyond volume our narrative is also indicative of PLTR’s TCV growth of~43% CAGR since FY2020, suggesting there may be limited opportunity for PLTR to offset volume constraints by pricing power

We are also cautious about the performance improvements AIP can bring to its current Foundry stack beyond building customer-facing platforms. While AIP certainly builds on the stack, it may be redundant for large industrial, utility, or automotive manufacturing operators. This could potentially impact pricing for newer entrants looking for AI solutions relative to market offering. AIP’s potential target mix lies in sub >$1MM TCV’s and >$5MM TCV’s, however face increased competition as PLTR’s can’t justify complexity premium.

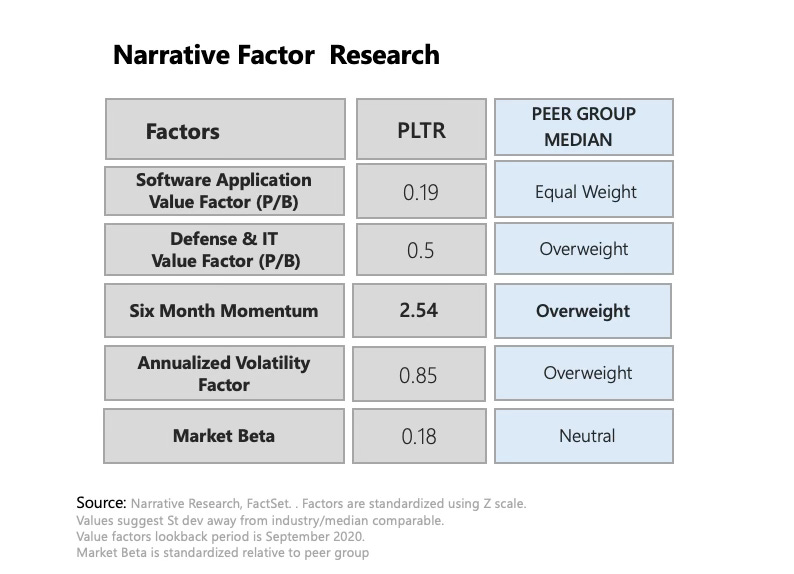

Investor expectations remain cautious, as the market views PLTR’s recent performance as fundamentally solid but with inconsistent growth. Its track record of over one year of positive EPS also warrants prudence regarding performance and valuation. Currently trading at a premium based on multiple metrics ,NR Factor research suggests that PLTR’s return’s have been driven by strong correlation of six-month momentum factor, and fundamental themes such as the S&P inclusion.

Price Target to $30.80/Share: Concurrent with downgrade to MP, we arrive at $30.8 by applying a 35x( discount to the large/mid cap median of 41.09x EV/FCF(CY26) and adding back $16.8 in net cash per share. This values PLTR at a modest discount to peer group SNOW_US, DDOG_US and at a premium to CRM. We also considered peer group in Defense and IT Sector, and the median range of 30x CY24, but arrived at at a premium based on PLTR >50% commercial segment exposure and limited concentration concerns in comparison.

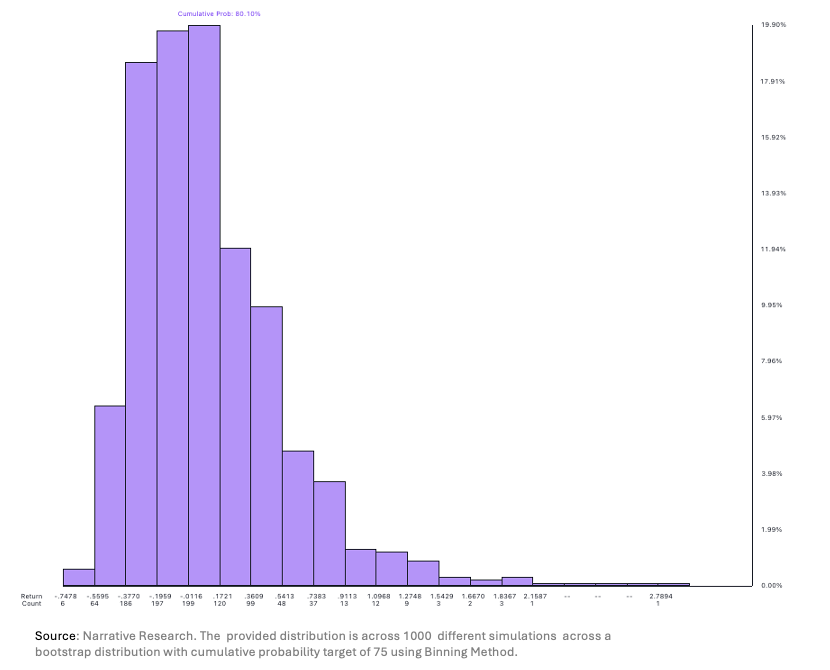

RISK REWARD CHART AND OPTIONS IMPLIED PROBABILITIES (12MM)

Source: Narrative Research uses Implied Volatility with 1 year dated expiration as a threshold for calculating probability of price target from the options market as of (Nov 8th 2024). We use standardized Z score integrating the implied volatility.MONTE CARLO SIMULATION For 3M Feb 2025 Forward Prices

Across the 1000 different simulations we notice -19.29% Expected Return with the second highest probability count of 197 allocationsNarrative Research | RESEARCH

BULL CASE $38.80

41.0x FY26 EV/FCF

25% FY24-FY28 revenue CAGR, on account of significant market share capture of +5% in Government segment and modest improvement in contract wins in middle market of >$5MM. We also expect TCV CAGR of ~32% for Foundry and Gotham platform providing unchallenged business intelligence software. There is room for optimism regarding Fed Start Program to become an important part of its offering to help boost commercial/government (mix). Palantir’s accreditations in the space is a highly specialized offering that maybe lucrative for businesses trying to enter government market.

These factors play into margin maintenance for the business at op.margin ~35% by FY26. Our margin’s are also driven by slowdown in G&A costs as an attribute of lowering headcount, PLTR has been trying to implement as cost solution. A 41.0X EV/FCF FY26 as median multiple of application software peers and discounted at WACC~ 11% yielding a forward twelve month $38.50 valuation.

BASE CASE $30.10

35x FY26 EV/FCF

Sustainable revenue growth of ~20% in FY25 and FY26, followed by a mid teens into the investment outlook. Mainly driven by PLTR reaching potential plateau in pricing power and slowdown in TCV CAGR of ~30%. Coupled by PLTR’s specialization in utility providers, auto sectors and manufacturing sectors reaching industry cap in growth rate. We value shares at 38x EV/FCF FY26 for peer group discounted at ~12% WACC. Our multiple of 38x implies a discount to mid/large cap application software.

BEAR CASE $23.00

32X FY26 EV/FCF

Declining revenue growth driven by deficits in defense and government spending. Factoring Foundry’s main competitive advantage at >$10MM contracts, leading to market share loss at lower end and middle market contract in commercial sector. The level of diminishing intelligence between AI/LM model’s (enterprise and non enterprise) we expect companies to build in-house solution for business intelligence operations.

Incremental spending in opex to recoup market share leading to dilution of margin over the next 4 years leading to op.margin of < 20% by FY2027. There is flexibility in cap structure to raise debt but we are expecting market environment to be fundamentally more mature for PLTR to recover marketshare. We applied a 32x FY26 EV/FCF as a premium over the Defense&IT sector considering the company trades closer to Defense peers driven by market share losses in commercial space. We assume at Discount rate of ~12%WACC, yielding a forward twelve month price target of $23.00.

Narrative Research | RESEARCH

Risk Reward- Palantir Technologies In (PLTR)

KEY EARNINGS INPUT

INVESTMENT DRIVERS

Consistent organic Revenue growth >20% CAGR, with middle market contract expansion

Sustainable margin of >30% across commercial and government revenue

RISK TO PT/RATING

RISK TO UPSIDE

Quicker than expected ramp in Generative AI products

Industry multiples continue to trade at high valuation well into peak of cycle (CY2027)

Large buybacks authorization and fast deployment of buyback program

RISK TO DOWNSIDE

Unsuccessful Fed Start program led by fiscal cuts on government spending

Low retention rate from Bootstrap Program, as customer conversion slows down

Demand for new Enterprise solution is crowded out by as enterprise utilize market available alternatives